Money doesn’t just sit in bank vaults after you deposit it. Banks use your deposits to make loans while keeping some cash on hand. This balance between lending and maintaining cash reserves is critical to our financial system. The reserve requirement ratio determines the amount banks must hold. This key banking concept affects everything from loan availability to interest rates. Understanding this ratio helps make sense of how banks work and how central banks control the money supply. The ratio serves as one of the primary tools for implementing monetary policy. Let’s explore what this ratio means for banks, consumers, and the overall economy.

What Is the Reserve Ratio?

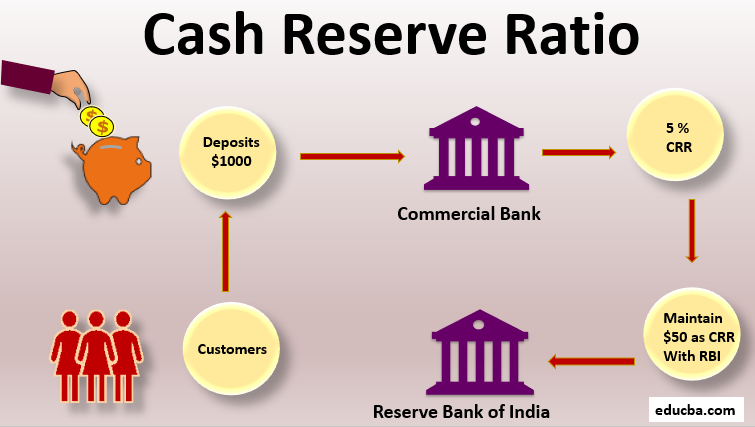

The reserve ratio represents the percentage of deposits banks must keep on hand. These funds cannot be loaned out to customers or invested elsewhere. Central banks set these requirements to ensure financial stability. The Federal Reserve establishes these standards for U.S. banks. Reserve requirements help protect depositors and maintain confidence in the banking system. They ensure banks can meet withdrawal demands from customers. Without adequate reserves, banks might face runs during financial panics.

My former colleague at a regional bank often explained that reserves work like a financial safety net. He compared it to keeping emergency cash at home for unexpected expenses. Financial institutions may hold more than the minimum required amount. These extra funds are called excess reserves. Banks typically maintain excess reserves during economic uncertainty. The ratio can change based on economic conditions and policy goals. Lower ratios allow banks to lend more money to borrowers. Higher ratios restrict lending but increase financial system stability.

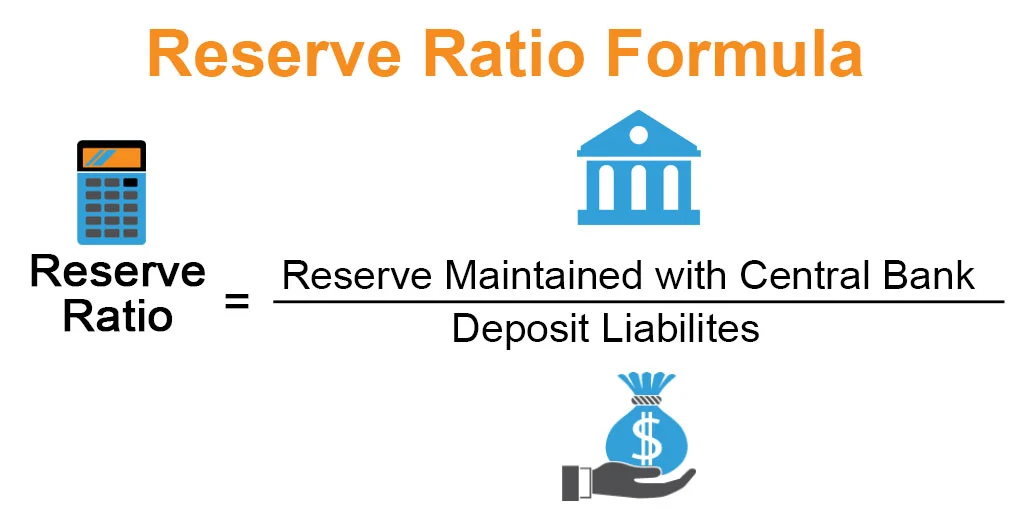

The Formula for the Reserve Ratio

Calculating the reserve ratio involves a straightforward formula. The reserve ratio equals the required reserves divided by deposit liabilities. You multiply this result by 100 to express it as a percentage. Banks use this formula to ensure compliance with regulations.

Required reserves include both vault cash and deposits at Federal Reserve Banks. Deposit liabilities refer to customer account balances subject to reserve requirements. Not all types of deposits require the same reserve percentage. Transaction accounts typically have higher requirements than savings accounts. Time deposits often have lower or zero reserve requirements.

The Federal Reserve adjusts these formulas periodically to implement monetary policy. They announce changes to give banks time to adjust their operations. Technological advances have made reserve calculation more accurate and efficient. Banks must report their reserve levels regularly to regulatory authorities.

What Does the Reserve Ratio Tell You?

The reserve ratio reveals much about monetary policy direction. A lower ratio signals the central bank wants to expand the money supply. This change makes more funds available for lending in the economy. Higher ratios indicate a desire to tighten the money supply and control inflation. The ratio directly affects banks’ ability to create money through lending.

This financial indicator helps forecast economic activity and credit availability. Analysts watch for changes to predict future interest rate trends. Businesses use this information for planning capital investments and expansions. Potential homebuyers might time their purchases based on expected credit conditions.

The ratio shows the balance between financial stability and economic growth. Too low a ratio might increase economic risk during downturns. Too high a ratio could unnecessarily restrict economic growth potential. Central banks carefully calibrate this balance based on economic conditions.

Reserve Ratio Guidelines

The Federal Reserve establishes specific reserve ratio guidelines for U.S. banks. These guidelines vary based on the size and type of financial institution. Currently, most transaction accounts have reserve requirements between 0% and 10%. The exact percentage depends on the account size and classification.

Before 2020, banks with over $127.5 million in deposits followed a 10% requirement. Those with deposits between $16.9 million and $127.5 million maintained a 3% ratio. The smallest banks with deposits under $16.9 million had no reserve requirement. These thresholds were adjusted annually based on growth in the banking system.

In March 2020, the Federal Reserve made a significant change. They reduced reserve requirements to zero percent for all depository institutions. This unprecedented move aimed to free up liquidity during the COVID-19 pandemic. The change allowed banks to use all deposits for lending and support economic recovery. This shift represented a major policy development in modern banking history.

Reserve Ratio and the Money Multiplier

The reserve ratio directly impacts the money multiplier effect in banking. This concept explains how initial deposits create additional money through lending. The money multiplier equals one divided by the reserve ratio. A lower ratio leads to a higher multiplier and greater money creation.

For example, with a 10% reserve requirement, the multiplier would be 10. This means $1,000 of new deposits could theoretically create $10,000 in new money. Banks take the initial deposit, keep 10% in reserve, and lend the rest. These loans become deposits in other accounts, continuing the cycle.

The multiplier effect has profound implications for monetary policy. Central banks can influence money supply growth by adjusting the ratio. However, the actual multiplier in practice is usually lower than the theoretical maximum. Other factors like banks’ willingness to lend also affect money creation. Economic conditions and loan demand further influence the real-world multiplier effect.

How Do You Calculate a Reserve Requirement?

Calculating a bank’s reserve requirement involves several steps. First, identify which deposits are subject to requirements. Then apply the appropriate percentage to each category. Add these amounts to determine the total reserve requirement.

For transaction accounts, multiply the account balance by the applicable percentage. Different reserve tranches may have different percentages. For example, you might apply 3% to one portion and 10% to another. Time deposits and personal savings accounts often have zero reserve requirements.

Banks must maintain their average reserves over a specified maintenance period. This period typically spans two weeks for larger institutions. The calculation includes both vault cash and balances held at Federal Reserve Banks. Modern banking systems track these calculations electronically for regulatory compliance. Banks face penalties if they fail to meet their reserve requirements.

Conclusion

The reserve requirement ratio remains fundamental to banking and monetary policy. It balances financial stability with economic growth objectives. Changes to this ratio can have far-reaching effects throughout the economy. The recent move to zero requirements marks a significant shift in the central banking approach.

Understanding this concept helps explain how banks operate and create money. It clarifies the relationship between deposits, loans, and the money supply. The ratio will continue evolving as banking practices and economic conditions change. Digital banking and alternative financial systems may further transform how reserves function.

Financial literacy should include knowledge of how these banking mechanisms work. They affect everyone’s access to credit and financial services. The reserve ratio, while technical, has practical implications for businesses and consumers alike. Its importance to economic stability cannot be overstated.

Also Read: How to Start an Online Business in 8 Steps

Banks failing to meet requirements face penalties and regulatory action. They may need to borrow from other banks or the Federal Reserve.

Yes, as demonstrated in 2020 when the Federal Reserve set all reserve requirements to zero.

No, each country’s central bank sets different requirements based on their economic conditions and policy goals.

Historically, changes were infrequent, occurring only when significant monetary policy shifts were needed.